Cancer Biologics Market Analysis | Worth USD 195.5 Billion by 2032, Growing at 7.5% During 2023-2032 | SNS Insider

Market Growth Driven by Increasing Incidence of Cancer and Technological Advancements in Biologic Therapies; Research and Regulatory Support by Governments.

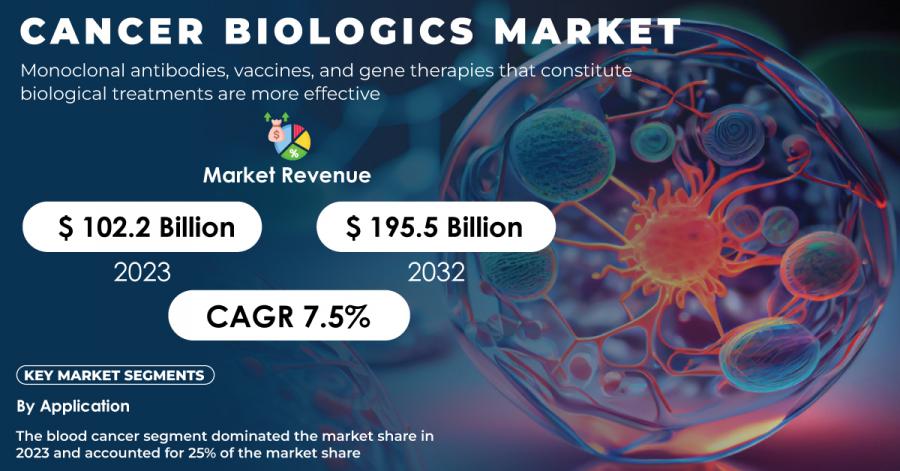

AUSTIN, TX, UNITED STATES, December 4, 2024 /EINPresswire.com/ -- According to SNS Insider, The Global Cancer Biologics Market size was valued at USD 102.2 Billion in 2023, and will reach USD 195.5 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.5% during the forecast period.

The cancer biologics market is in a transformative phase, driven by the ever-increasing prevalence of cancer and the emphasis on innovative therapies. According to the World Health Organization, in 2023, cancer killed more than 10 million people, highlighting the need for advanced treatment solutions. Governments around the world are now taking action to combat this health crisis. For instance, in 2023, the U.S. The NCI had allocated USD 7.6 billion to conduct cancer research, up 8% compared to last year.

Regulatory bodies like the European Medicines Agency (EMA) and China's National Medical Products Administration (NMPA) have established expedited approval pathways for innovative biologics. This will ensure faster access to life-saving therapies and further accelerate market growth.

Get a Free Sample Report of Cancer Biologics Market @ https://www.snsinsider.com/sample-request/4512

Market Analysis

The growing burden of cancer, an aging global population, and environmental risk factors have driven the growth of the cancer biologics market. Cancer is a major cause of death around the world, often remaining unnoticed until it is in advanced stages, which is the reason for the immediate demand for precise and effective treatments.

Biologics, including monoclonal antibodies, gene therapies, and vaccines, are revolutionizing oncology by targeting cancer cells with minimal damage to healthy tissues. This precision, coupled with fewer side effects than traditional therapies, is fueling their adoption. Governments worldwide are hastening financial support and regulatory reforms to advance biologics. For example, in 2023, the U.S. While the FDA put many biologics up for review, and the European Medicines Agency (EMA) and other regulatory agencies expedited approvals of rare cancer drugs.

Key Cancer Biologics Market Players:

Gilead Sciences Inc.

F. Hoffmann-La Roche Ltd.

Amgen Inc.

GSK plc.

Eli Lilly and Company

Bristol-Myers Squibb Company

Pfizer Inc.

Abbott

AstraZeneca

Johnson & Johnson Services Inc.

Segment Analysis

By Application

The blood cancer area segment dominated the market in 2023, with a 25% market share. Gains in leukemia and lymphoma, with 1.3 million Americans living with or in remission from blood cancers, have fueled massive investments in this sphere. The NCI will dedicate USD 500 million of its budget to blood cancer research in 2023, guaranteeing continued growth for biologic therapies.

The breast cancer segment has the fastest growth as it is highly prevalent, with 2.3 million new cases reported worldwide (WHO, 2023). Governments and organizations are intensifying efforts to improve early detection and treatment. Innovations such as immune checkpoint inhibitors and antibody-drug conjugates are advancing breast cancer care, supported by increased funding for screening and biologics development.

By End-User

In 2023, The hospital segment dominated the market, accounting for over 45% of the market share, owing to its infrastructure for complex therapies. The Cancer Centers Program under the U.S. allocated USD 4 billion in 2023 to enhance oncology facilities. Hospitals are also in line to benefit from the government grants that are made to expand biological therapy capabilities, thus ensuring their dominance in the segment.

The cancer centers segment, however, is expected to grow at the fastest CAGR during 2024-2032 due to a shift toward specialized care. As of 2023, more than 70 NCI-designated cancer centers exist in the U.S. with robust government funding dedicated to biologics-focused treatment development.

Need any customization research on Cancer Biologics Market, Enquire Now @ https://www.snsinsider.com/enquiry/4512

Key Market Segments

By Drug Class

Monoclonal Antibodies (mAb)- major share

Naked mAb

Conjugated mAb

Bispecific mAb

Recombinants Proteins

Cancer Growth Inhibitors

Tyrosine Kinase Inhibitors

mTOR Inhibitors

Others (proteasome inhibitors)

Vaccines

Preventive Vaccines

Therapeutic Vaccines

CAR-T Cells

Angiogenesis Inhibitors

Interleukins (IL)

Others (interferons (IFN), gene therapy, etc.)

By Application

Blood Cancer

Lung Cancer

Breast Cancer

Colorectal Cancer

Prostate Cancer

Gastric Cancer

Ovarian Cancer

Others

By End-user

Hospitals

Cancer Centers

Academics & Research Institutes

Regional Insights

In 2023, North America dominated the market with a market share of 40%. Factors such as a high prevalence of cancer, strong healthcare infrastructure, and initiatives like the Cancer Moonshot Initiative have contributed to this high market share. The streamlined regulatory pathways of the FDA and increasing investment in biologics research also support growth.

Canada also took steps, with the government-backed programs improving the availability of biologics and financing massive cancer research programs. Collectively, all these efforts have placed North America at the top of the cancer biologics market.

Recent Developments

In October 2024, the FDA Approved Bristol Myers Squibb Company’s Nivolumab for Early-Stage NSCLC, The FDA approved nivolumab (Opdivo) in combination with platinum doublet chemotherapy for the treatment of resectable non-small cell lung cancer, followed by adjuvant nivolumab monotherapy, which addresses an important gap in early-stage lung cancers and improves the survival chances of patients.

In January 2024, the European Commission authorized Roche's Tecentriq SC; this was the first available in Europe PD-L1 cancer immunotherapy administered via subcutaneous injections to patients with various types of cancer. This innovation will save more time for the patient compared to traditional methods involving intravenous injections

Buy Full Research Report on Cancer Biologics Market 2024-2032 @ https://www.snsinsider.com/checkout/4512

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Cancer Biologics Market by Drug Class

8. Cancer Biologics Market by Application

9. Cancer Biologics Market by End-user

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/4512

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider Pvt. Ltd

415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release