Non-Alcoholic Beverages Market to Reach $2,135 Billion by 2033, Growing at 6.1% CAGR from 2023

Non-Alcoholic Beverages Market is anticipated to be USD 2,135 billion by 2033. It is record a steady CAGR of 6.1% in 2023 to 2033. USD 1,349 bn in 2023.

NEW YORK, NY, UNITED STATES, February 3, 2025 /EINPresswire.com/ -- Overview

The global non-alcoholic beverages market is projected to reach USD 2,135 billion by 2033, growing at a CAGR of 6.1% from 2023 to 2033. This growth is fueled by an increasing consumer focus on health and wellness and a demand for beverage options beyond traditional sugary drinks. Non-alcoholic beverages include a wide range of products such as soft drinks, juices, bottled water, and ready-to-drink teas and coffees. The burgeoning popularity of functional drinks, which offer additional health benefits like energy boosts or immune support, is a significant market driver.

Consumers increasingly prefer options with natural ingredients, less sugar, and health advantages. Additionally, the convenience factor is pivotal, with more consumers opting for ready-to-drink formats to accommodate busy lifestyles. The demand for these beverages is further shaped by the movement towards sustainability and eco-friendly packaging. As consumer preferences evolve, companies in the non-alcoholic beverages market continue to innovate and expand their product offerings to include organic, plant-based, and functional drink options, effectively meeting the diverse needs of the global market.

Key Takeaways

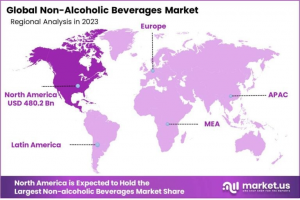

• Market Growth: The Global Non-Alcoholic Beverages Market is anticipated to be USD 2,135 billion by 2033. It is estimated to record a steady CAGR of 6.1% in the Forecast period 2023 to 2033. It is likely to total USD 1,349 billion in 2023.

• By Product Type Analysis: The Soft Drinks segment emerged as a dominant force, capturing an impressive market share of over 58.6%.

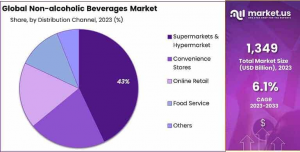

• By Distribution Channel Analysis: Supermarkets & Hypermarkets stood out as the dominant force, securing a commanding market position with a share exceeding 43%.

• Driving Factors: Consumers’ increasing focus on health and wellness is driving the demand for non-alcoholic beverages, especially those with natural components and functional ingredients.

• Restraining Factors: High sugar content in non-alcoholic drinks is a major concern for health-conscious consumers.

• Growth Opportunities: The trend towards plant-based diets offers significant growth opportunities, including dairy-free options.

• Regional Analysis: North America dominates the market, driven by a focus on health and wellness.

• Key Players: Major players include The Coca-Cola Co, PepsiCo Inc, Monster Beverage Corp, Keurig Dr Pepper Inc, and more.

👉 Request a free sample PDF report for valuable insights: https://market.us/report/non-alcoholic-beverages-market/request-sample/

Experts Review

Government incentives and technological innovations significantly impact the non-alcoholic beverages market. Regulatory measures, including sugar taxes and environmental regulations, challenge manufacturers but also drive healthier product development. Technological innovations have led to the creation of beverages with functional benefits, using advanced processing techniques and novel ingredients. Investment opportunities are ample, particularly in functional and plant-based drink sectors, albeit with risks related to regulatory compliance and market saturation. With increasing consumer awareness around health, beverages with low sugar content and added health benefits have seen a surge in demand, while high-sugar products face resistance. To maintain competitiveness, companies must navigate this complex regulatory environment, balancing between consumer demand for innovative and healthy options and the constraints imposed by regulatory bodies.

Report Segmentation

The non-alcoholic beverages market is segmented by product type and distribution channel. By product type, it includes bottled water, soft drinks, juices, and ready-to-drink coffee and tea. Soft drinks dominate, holding over 58.6% of market share due to their diverse range encompassing carbonated, non-carbonated, and energy drinks. Juices, particularly from fruits such as oranges and apples, are popular among health-conscious consumers seeking lower sugar alternatives. Ready-to-drink coffee and tea have gained traction for convenience and health benefits.

In terms of distribution channels, supermarkets and hypermarkets lead with a 43% market share, favored for their comprehensive range and competitive pricing. Convenience stores follow, appealing to consumers seeking quick, on-the-go options. Online retail is expanding rapidly, driven by the e-commerce boom and the convenience of home delivery, while food service establishments offer specialty drink experiences, contributing to the sector’s diversity.

Key Market Segments

By Product Type

• Bottled Water

• Soft Drinks

————Carbonated Soft Drinks

————Non-Carbonated Soft Drinks

————Energy & Sports Drinks

• Juices

————Orange Juice

————Apple Juice

————Grapefruit Juice

————Pineapple Juice

————Grape Juice

————Others

• Ready-to-Drink (RTD) Coffee & Tea

————Ready-to-Drink (RTD) Coffee

————Ready-to-Drink (RTD) Tea

By Distribution Channel

• Supermarkets & Hypermarket

• Convenience Stores

• Online Retail

• Food Service

• Others

👉 Buy Now to access the full report: https://market.us/purchase-report/?report_id=26499

Drivers, Restraints, Challenges and Opportunities

• Drivers: The rising awareness of health and wellness drives demand for non-alcoholic beverages with functional ingredients. Innovative products offering plant-based and low-sugar options fuel market growth. Rapid urbanization and changing lifestyles further boost this sector.

• Restraints: High sugar content in many traditional non-alcoholic beverages poses health concerns, hampering market expansion. Regulatory pressures, such as sugar taxes, increase compliance costs, limiting product variety and heightening competition.

• Challenges: Environmental concerns about plastic pollution necessitate sustainable packaging solutions, imposing additional costs on manufacturers. Competing beverage categories, such as plant-based milk and energy drinks, fragment the market, challenging established brands.

• Opportunities: The trend towards plant-based diets presents opportunities for dairy-free non-alcoholic beverages. The growing e-commerce landscape enables companies to reach wider audiences. Emerging markets with increasing disposable incomes offer new consumer bases.

Key Player Analysis

The non-alcoholic beverages market features several key players, including The Coca-Cola Co, PepsiCo Inc, and Monster Beverage Corp. These companies remain competitive by leveraging strategic branding, marketing, and product innovation. Their extensive distribution networks reinforce their market positions. In addition to these multinationals, regional entities and specialized brands like Arizona Beverage Company and Red Bull GmbH contribute to diversity and cater to niche markets with unique offerings. The focus on healthy and functional drinks has spurred investments in research and development to align products with evolving consumer preferences. These players also consider sustainability initiatives, such as reducing plastic usage, to address the growing environmental concerns among consumers.

Top Key Players

• The Coca-Cola Co

• PepsiCo Inc

• Monster Beverage Corp

• Keurig Dr Pepper Inc

• Fomento Economico Mexicano SAB de CV

• Arizona Beverage Company

• Asahi Group Holdings Ltd

• Danone S.A

• Nestle SA

• Unilever Plc

• Red Bull GmbH

• Dr. Pepper Snapple Group Inc

Recent Developments

In recent years, industry players have made several notable advancements to strengthen their market positions. In July 2022, PepsiCo launched its largest bottling plant in Colorado, emphasizing sustainability with aims for 100% renewable electricity. Red Bull introduced a limited-time summer edition with strawberry and apricot flavors in March 2022, highlighting its strategy of seasonal innovation. Such developments showcase the continuous efforts of major companies to cater to shifting consumer demands while striving for sustainability. These initiatives reflect the broader market movement toward healthier, environmentally friendly beverage solutions and underscore the competitive nature of the industry, which increasingly prioritizes innovation and sustainability in product offerings.

Conclusion

The global non-alcoholic beverages market is poised for substantial growth, driven by consumer trends toward health and convenience, coupled with increasing demand for novel and functional beverages. While the industry faces challenges from regulatory measures and environmental concerns, the focus on product innovation and sustainable practices presents opportunities for growth and differentiation. Key players continue to drive innovation and expand their reach through strategic distribution and marketing efforts. As the landscape evolves, companies that can adeptly balance consumer needs with regulatory compliance and sustainability stand to succeed in this competitive and dynamic market.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Food & Beverage Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release